Introduction to Soto Law Firm's Estate Planning Services

Home » Fundamental Estate Planning

Scottsdale and Tempe, Arizona Estate Planning Law Firm

Estate planning is vital for ensuring your assets are distributed according to your wishes after your death. It protects your beneficiaries and can significantly reduce estate and death taxes.

This planning provides peace of mind, by avoiding the lengthy and costly probate court process, preventing family disputes over inheritance, and allowing for quicker, more private asset distribution. Proper planning also includes arrangements for your personal and medical care in case of incapacity. Estate planning is a crucial step for securing your legacy and ensuring your wishes are honored.

At Soto Law Firm, serving Tempe and Scottsdale, Arizona, the East Valley and surrounding areas, we specialize in a range of legal strategies, including wills, revocable living trusts, irrevocable trusts, durable powers of attorney, and health care directives. Many new clients in Arizona believe they lack an estate plan and are often surprised to discover that if you fail to plan, Arizona law creates a default plan for you which will control what happens in the event of your death or mental incapacity. This default plan can lead to disastrous unintended results. By crafting a well-thought-out estate plan with a skilled attorney from Soto Law Firm, you can replace the state’s default scheme with one that aligns with your individual goals, desires, and intentions. Begin your estate planning journey in Tempe or Scottsdale with our experienced legal guidance.

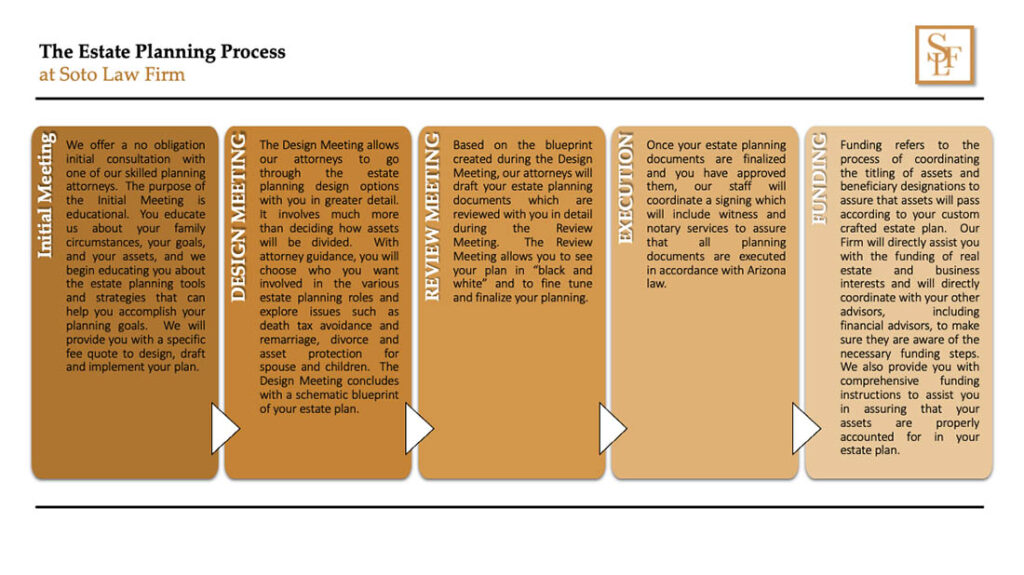

Initial Meeting

We offer a no obligation initial consultation with one of our skilled planning attorneys. The purpose of the Initial Meeting is educational. You educate us about your family circumstances, your goals, and your assets, and we begin educating you about the estate planning tools and strategies that can help you accomplish your planning goals. We will provide you with a specific fee quote to design, draft and implement your plan.

Design Meeting

The Design Meeting allows our attorneys to go through the estate planning design options with you in greater detail. It involves much more than deciding how assets will be divided. With attorney guidance, you will choose who you want involved in the various estate planning roles and explore issues such as death tax avoidance and remarriage, divorce and asset protection for your spouse and children. The Design Meeting concludes with a schematic blueprint of your estate plan.

Review Meeting

Based on the blueprint created during the Design Meeting, our attorneys will draft your estate planning documents which are reviewed with you in detail during the Review Meeting. The Review Meeting allows you to see your plan in “black and white” and to fine tune and finalize your planning.

Execution

Once your estate planning documents are finalized and you have approved them, our staff will coordinate a signing which will include witness and notary services to assure that all planning documents are executed in accordance with Arizona law.

Funding

Funding refers the process of coordinating the titling of assets and beneficiary designations to assure that assets will pass according to your custom crafted estate plan. Our Firm will directly assist you with the funding of real estate and business interests and will directly coordinate with your other advisors, including financial advisors, to make sure they are aware of the necessary funding steps. We also provide you with comprehensive funding instructions to assist you in assuring that your assets are properly accounted for in your estate plan.

Comprehensive Services Offered

Our suite of services encompasses all aspects of estate planning:

Revocable Living Trust

A revocable trust, also known as a living trust, is a legal entity used to hold and manage assets. You can alter or amend it at any time during your lifetime. This flexibility allows you to make changes as personal circumstances or intentions change. Assets placed in a revocable trust pass directly to the beneficiaries upon your death, bypassing the often lengthy and public process of probate. You maintain control over the assets while alive and you can appoint a trustee of your choosing to manage them upon your death or incapacity. Upon your death, the trust becomes irrevocable, and the assets are distributed according to the terms you set forth in the trust. This type of trust is often the foundation of most of our client’s estate plans, as it provides a means to manage assets during your lifetime and ensures a smoother transition of assets after death.

Last Will and Testament

A Last Will and Testament is a legal document that outlines your wishes regarding the distribution of your assets and the care of any minor children upon your death. This document allows you to specify how your assets should be distributed at your death and enables you to appoint an executor, who is responsible for carrying out the terms of the will and overseeing the probate process. Additionally, a will is the document where guardians for your children can be named in the event of an untimely death. A last will and testament becomes active only after death and must go through the probate court process. Because a will does not avoid the probate court process, most of our clients choose to plan with revocable living trusts.

General Durable Power of Attorney

A General Durable Power of Attorney is a legal document that allows you (the principal) to appoint someone you trust (known as the agent or attorney-in-fact) to manage your financial affairs. This can include paying bills, managing investments, or making other financial decisions on your behalf if you are unable to act for yourself. Its purpose is to ensure that someone you trust can handle your finances during times when you might not be able to do so. It’s a valuable tool for planning for potential future health or cognitive issues. It’s an essential tool for all estate plans.

Healthcare Power of Attorney

A Healthcare Power of Attorney is a legal document that allows you to appoint someone you trust, often referred to as your agent or proxy, to make medical decisions for you in case you’re unable to do so yourself. This could happen if you’re unconscious, mentally incapacitated, or otherwise unable to communicate your healthcare wishes. Your chosen agent would then have the authority to make decisions about your medical treatment based on your preferences and best interests. A healthcare power of attorney ensures that your healthcare decisions remain in the hands of someone you trust, rather than being left up to medical professionals or court decisions. It’s a key component of all of our clients’ estate plans.

Living Will

A Living Will is a legal document that lets you outline your preferences for medical treatment in case you become unable to communicate or make decisions for yourself. This might include instructions on life-sustaining measures, like whether or not you want to be placed on a ventilator or receive artificial nutrition and hydration if you’re in a terminal condition or a permanently unconscious state. Having a Living Will ensures that your healthcare providers and loved ones are aware of your wishes, guiding them during difficult and emotional decisions. It’s an essential part of all of our clients’ estate plans.

HIPAA Authorization

A HIPAA Authorization is a legal document that allows you to grant specific people access to your protected health information. HIPAA, which stands for the Health Insurance Portability and Accountability Act, sets strict rules on who can view or receive your health information. With a HIPAA Authorization, you can give permission to family members, friends, or others whom you trust to access your medical records or discuss your health with doctors. The document specifies who can receive the information and what health information can be shared. It’s an essential planning tool for all of our clients, as it ensures that those you care about are informed about your health status, particularly in emergencies or when you are unable to communicate your medical history yourself.

Advanced Estate Planning Strategies in Arizona

For clients with a net worth large enough to be subject to estate and death taxes, we often implement the following strategies:

Spousal Lifetime Access Trust (SLAT)

A Spousal Lifetime Access Trust (SLAT) is an estate planning tool designed for married couples. It allows one spouse (the donor) to transfer assets into a trust for the benefit of the other spouse (the beneficiary). This trust has several advantages:

**It’s important to note that once assets are placed in a SLAT, the transaction is irrevocable. Therefore, it’s crucial to carefully consider the terms and conditions of the trust before setting it up.

- Asset Protection and Access: Although the assets are moved out of the donor’s estate (which can help reduce estate taxes), the beneficiary spouse can still have access to these assets, providing financial security and flexibility.

- Estate Tax Benefits: By transferring assets to a SLAT, they are removed from the donor's taxable estate. This can be a significant advantage in reducing potential estate taxes upon the donor’s death.

- Lifetime Benefits: The beneficiary spouse can receive distributions from the SLAT during their lifetime, which can be structured according to the terms set in the trust.

- Control: The donor spouse can set specific terms for how the trust's assets are managed and distributed, offering a degree of control over the assets even after they have been transferred.

- Generational Wealth Transfer: SLATs can also be used to pass wealth to future generations (like children and grandchildren) in a tax-efficient manner.

Irrevocable Life Insurance Trust (ILIT)

An Irrevocable Life Insurance Trust (ILIT) is a specialized trust designed to hold and manage a life insurance policy. This type of trust is set up to own your life insurance policy, which means the trust becomes the policyholder. Here are the key points about an ILIT:

- Estate Tax Savings: The primary benefit of an ILIT is that it removes the life insurance policy from your taxable estate. This means that the proceeds from the insurance policy, when paid out, are not subject to estate taxes, potentially saving a significant amount of money.

- Control of Proceeds: An ILIT allows you to have more control over how the proceeds from your life insurance policy are distributed after your death. You can set terms within the trust for when and how beneficiaries receive the insurance money.

- Protection from Creditors: An ILIT allows you to have more control over how the proceeds from your life insurance policy are distributed after your death. You can set terms within the trust for when and how beneficiaries receive the insurance money.

- Irrevocable Nature: Once an ILIT is created and the insurance policy is transferred into it, the trust is irrevocable. This means it cannot be changed or dissolved without the consent of the beneficiaries.

- Paying Policy Premiums: You can gift money to the ILIT, which can then be used to pay the premiums on the life insurance policy. This can be done in a way that utilizes the annual gift tax exclusion, further enhancing the tax efficiency of the trust.

Dynasty Trust

A Dynasty Trust is a long-term trust created to pass wealth from generation to generation without incurring transfer taxes like estate and gift taxes for as long as the trust assets remain in the trust. Here's a simplified explanation:

- Long-Term Asset Protection: The main feature of a Dynasty Trust is its duration. It can last for many generations, potentially indefinitely, depending on state laws. This allows wealth to be preserved and grown over a long period.

- Tax Benefits: By placing assets in a Dynasty Trust, they are shielded from estate taxes each time they pass to the next generation. This can result in significant tax savings, especially for high-net-worth families.

- Control Over Assets: You can set specific rules and conditions in the trust about how and when the assets are distributed to beneficiaries. This means you can influence how your wealth is used by future generations.

- Protection from Creditors and Divorce: Assets in a Dynasty Trust are generally protected from beneficiaries’ creditors, including in cases of divorce, lawsuits, or bankruptcy.

- Preservation of Family Wealth: It's an effective tool for families looking to maintain and control their wealth across several generations, ensuring that it benefits not just your children, but potentially your grandchildren and beyond.

Family Limited Partnership (FLP)

A Family Limited Partnership (FLP) is a type of business entity that allows family members to pool their assets into a business partnership while retaining control over how these assets are managed. Here’s a breakdown of its key features:

- Management and Control: In an FLP, family members are typically divided into two groups: general partners and limited partners. General partners manage the FLP and make all the business decisions, while limited partners usually have no management authority but share in the profits.

- Asset Protection: Assets within an FLP are generally protected from personal creditors of the partners. This means if a family member has personal financial issues, the assets in the FLP are usually safeguarded.

- Estate and Gift Tax Benefits: FLPs can offer tax benefits for estate planning. Parents can transfer assets to their children through the FLP while retaining control over those assets. The value of these transfers can be reduced for gift and estate tax purposes, potentially resulting in tax savings.

- Succession Planning: An FLP can be a useful tool for transitioning ownership of family assets to the next generation in a structured way, while still providing income to the older generation.

- Family Governance and Unity: It encourages family members to work together and make decisions collectively about family assets, fostering a sense of unity and shared purpose.

Intentionally Defective Grantor Trust (IDGT)

An Intentionally Defective Grantor Trust (IDGT) is a type of irrevocable trust that's used in estate planning to minimize taxes while transferring wealth to beneficiaries. Here's an overview of how it works:

- Separation of Income Tax and Estate Tax Treatment: The 'intentionally defective' part refers to the trust being set up in a way that removes the assets from your estate for estate tax purposes, but you still pay income tax on the trust's earnings. This sounds unusual, but it's a strategic move for tax purposes.

- Freezing Asset Values for Estate Taxes: When you transfer assets into an IDGT, their value for estate tax purposes is 'frozen' at the time of transfer. Any future appreciation of these assets won't be part of your taxable estate. This can be particularly beneficial if you expect these assets to increase significantly in value.

- Continued Income Tax Responsibility: As the grantor, you continue to pay income taxes on the trust’s earnings. This actually benefits your beneficiaries, as the trust can grow without being reduced by taxes, and it further reduces your taxable estate.

- Asset Transfer to Beneficiaries: The assets in the IDGT are eventually passed to your beneficiaries, typically without incurring additional estate taxes.

- Estate Planning Flexibility: IDGTs offer a degree of flexibility in estate planning, allowing for the strategic transfer of wealth, particularly in the case of appreciating assets.

Charitable Trusts

Charitable trusts are special types of trusts designed to support charitable causes while providing certain financial benefits to the donor. There are mainly two types: Charitable Remainder Trusts (CRTs) and Charitable Lead Trusts (CLTs).

Key Benefits:

- Tax Advantages: Both types of charitable trusts offer tax benefits. CRTs can provide immediate income tax deductions and potential capital gains tax relief, while CLTs can reduce estate and gift taxes.

- Income Stream: CRTs can provide you or other beneficiaries with a source of income for a period of time.

- Legacy of Giving: Both CRTs and CLTs allow you to support charitable causes in a significant way, aligning your estate planning with your philanthropic goals.

- Charitable Remainder Trust (CRT): In a CRT, you transfer assets into the trust and receive a tax deduction at the time of the transfer. The trust then pays you or other designated beneficiaries a stream of income for a period of time. After this period ends, or upon your death, the remaining assets in the trust go to the chosen charity. It's a way to receive income and tax benefits while ultimately supporting a charity.

- Charitable Lead Trust (CLT): This trust works somewhat in reverse. The charity receives an income stream from the trust for a set number of years, and after this period, the remaining assets are passed to your beneficiaries, often with significant estate and gift tax savings.

Grantor Retained Annuity Trusts (GRATs)

Grantor Retained Annuity Trusts (GRATs) are estate planning tools used to transfer assets to beneficiaries while minimizing taxes. Here’s a simple breakdown:

- Transfer of Assets: As the grantor, you place assets into the GRAT. These assets are often expected to appreciate in value.

- Receiving Annuity Payments: In return, the GRAT pays you a fixed annuity for a set number of years. The amount of this annuity is based on a percentage of the initial value of the assets you contributed.

- Passing Assets to Beneficiaries: After the annuity payment period ends, any assets remaining in the trust are passed to your beneficiaries, typically your children, free of additional taxes.

- Tax Efficiency: The key benefit of a GRAT is its tax efficiency. The value of the gift to your beneficiaries is calculated using IRS rules at the time you transfer the assets into the trust. If the assets grow at a rate higher than the IRS's assumed rate, that excess growth passes to your beneficiaries tax-free.

- Short-Term Planning Tool: GRATs are often set up for relatively short periods, like 2-10 years, making them particularly useful for assets expected to appreciate quickly.

- Reduced Estate Taxes: By moving appreciating assets out of your estate, a GRAT can help reduce your future estate tax liability.

Qualified Personal Residence Trusts (QPRTs)

Qualified Personal Residence Trusts (QPRTs) are estate planning tools used to reduce the taxable value of your home when passing it to your beneficiaries, typically your children. Here's a summary of how it works:

- Transferring Your Home: You transfer your personal residence into the QPRT. This can be your primary home or a vacation home.

- Retained Right to Live in the Home: After transferring the home into the QPRT, you retain the right to live in the home for a specified number of years, known as the “term” of the trust.

- Passing the Home to Beneficiaries: At the end of the term, the home passes to your beneficiaries. If you wish to continue living there after the term, you can do so by paying rent at the fair market value, which further reduces your taxable estate.

- Tax Benefits: The value of the gift to your beneficiaries (the future interest in the home) is discounted for gift tax purposes because you retain the right to live in the home for the term of the trust. This can result in substantial gift and estate tax savings, especially if the home appreciates in value.

- Potential Risks: If you pass away before the term of the QPRT ends, the home reverts to your estate and is taxed as part of it, negating the tax benefits of the QPRT.

Estate Planning Strategy: QPRTs are an effective strategy for those who have a significant portion of their wealth tied up in their home and are looking for ways to minimize estate taxes.

Why Choose Soto Law Firm for Estate Planning?

Choosing Soto Law Firm means opting for a team that values your peace of mind above all:

- Expertise in Arizona Estate Law: Our deep understanding of local laws ensures your estate plan is robust and effective.

- Client Testimonials: The experiences of our clients speak to our commitment and effectiveness in providing tailored estate planning services.

- Personalized Approach: We take the time to understand your unique situation, ensuring your estate plan is a perfect fit for you and your family.

At Soto Law Firm, we believe that a well-crafted estate plan is more than a legal necessity; it’s a gift of peace for you and your loved ones. Our dedicated team is ready to guide you through every step of this important journey. Let us help you create a legacy that stands the test of time.

We invite you to schedule a consultation with us. This is your opportunity to discuss your estate planning needs with a team that cares. Contact us today to take the first step towards securing your legacy and achieving peace of mind.